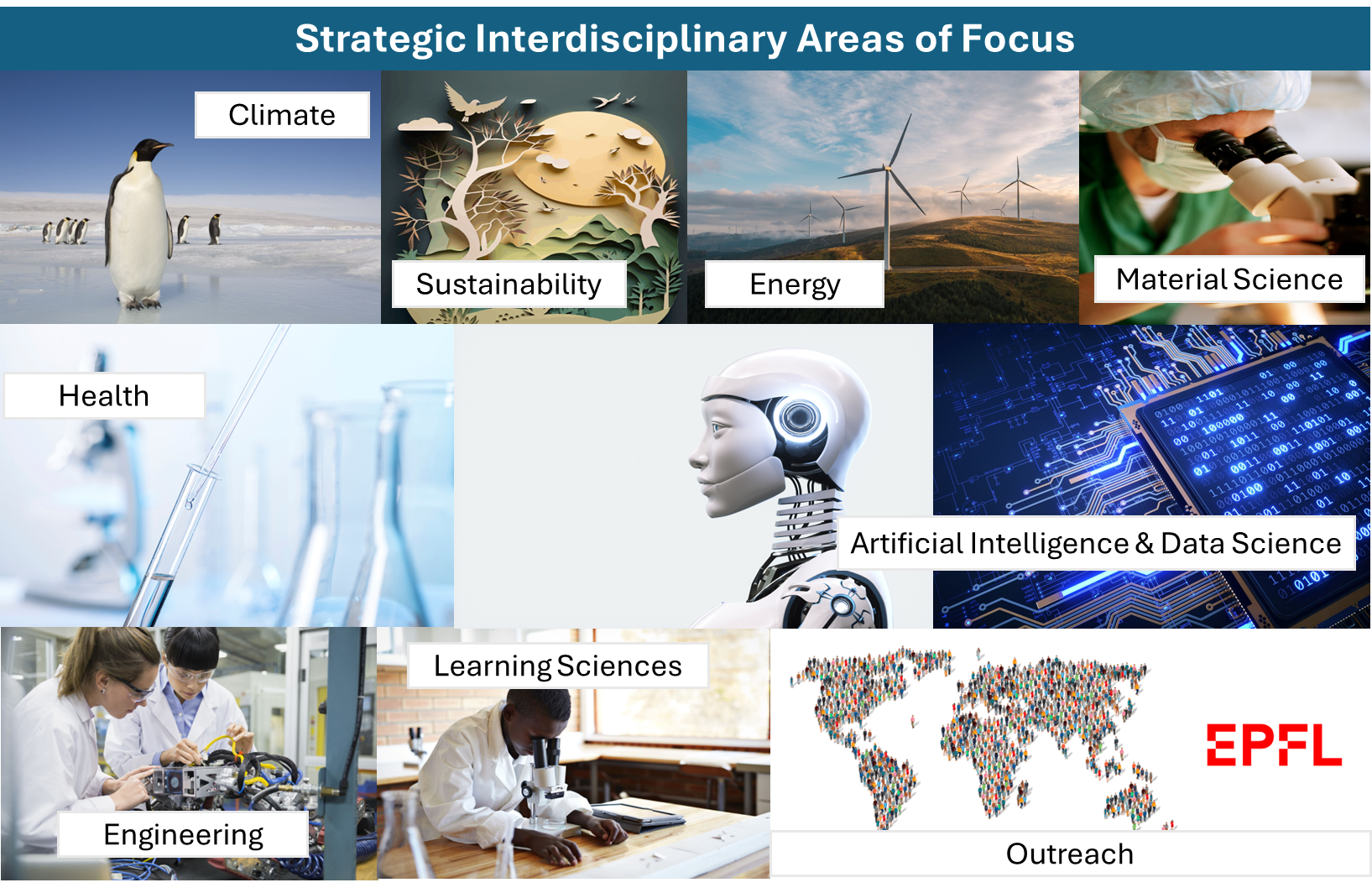

Research Domains

@copyright 2023 EPFL Alain Herzog

EPFL Institutes

EPFL institutes are principal organisational units housing the various disciplines in which EPFL’s research enterprise is active. Institutes belong to one or two of EPFL’s Schools, and are listed below in alphabetical order.

Discover all Institutes

Civil Engineering Institute (IIC)

Environmental Engineering Institute (IIE)

Institute for Area and Global Studies (IAGS)

Institute of Architecture (IA)

Institute of Bioengineering (IBI)

Institute of Chemical Sciences and Engineering (ISIC)

Institute of Electrical and Micro Engineering (IEM)

Institute of Mathematics (MATH)

Institute of Mechanical Engineering (IGM)

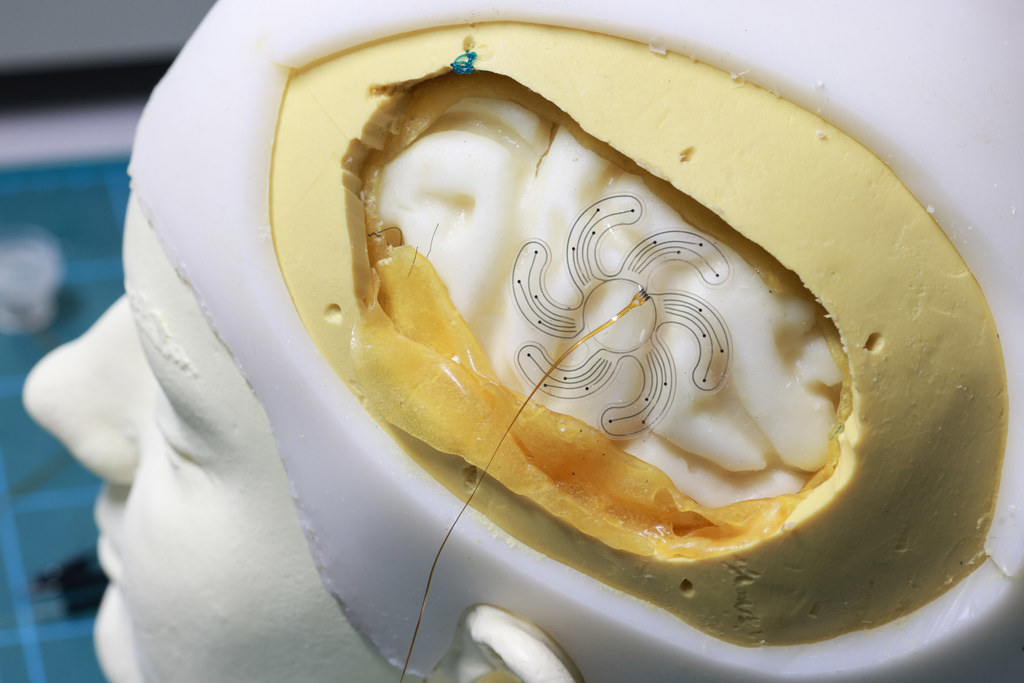

Interschool Institute Neuro-X (INX)

Management of Technology & Entrepreneurship Institute

Swiss Institute for Experimental Cancer Research (ISREC)

EPFL Research Centers

EPFL’s Centers build research communities and foster synergies across disciplinary boundaries within the EPFL research enterprise, provide open research platforms that offer access to major research infrastructure, and house research initiatives common to EPFL and other institutions within or beyond the academic world.

Discover all Centers

EPFL Facilities I Technology Platforms

EPFL Facilities provide access to cutting-edge research infrastructure and expertise to EPFL scientists and students. They are also a place where knowledge and knowhow is shared and where EPFL contributes to advance the state of the art in the techniques covered by each shared facility.

Discover all Facilities

Material

Molecular and Hybrid Materials Characterization Center

X-Ray Diffraction and Surface Analytics Platform (ISIC-XRDSAP)

Crystal Growth and Characterization Plateform

Chemistry

Central Environmental Laboratory

Mass Spectrometry and Elemental Analysis Platform (ISIC-MSEAP)

Nuclear Magnetic Resonance Platform (ISIC-NMRP)

Life science

Biomolecular Screening Core Facility

Bioelectron Microscopy Core Facility

Bioengineering & Technology Facility

Mechanical

Student Kreativity and lnnovation Laboratory

Plateforme Ateliers Techniques

Atelier de Fabrication Additive (Impression 3D)

Atelier de fabrication de Circuits Imprimés.

Atelier de l’institut de génie mécanique

Atelier de l’Institut de production et robotique

Atelier de l’Institut des Matériaux

Electronic and Mechanical Engineering Workshops Platform

Bio – Micro – Nano

Center of MicroNanoTechnology (CMI)

Interdisciplinary Focus Areas

Interdisciplinary Focus Areas pool the expertise of EPFL scientists on crucial topics that drive the institution’s strategic research agenda and address global challenges and foster innovation.